Lucrative

Get a straightforward, fast service on-the-go. One document is all you need

Get a straightforward, fast service on-the-go. One document is all you need

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

Quick and simple, without the hassle. Instant fund transfers with extended loan options

Place your request via our app, just by filling out the form.

Hold on for our response, coming in just 15 minutes.

Accept your funds, normally transferred in about one minute.

Place your request via our app, just by filling out the form.

Download loan app

Small payday loans have become a popular financial solution for many individuals in South Africa who find themselves in need of quick cash to cover unexpected expenses or emergencies. These short-term loans provide immediate financial relief to borrowers while offering a range of benefits that make them a convenient and practical option for those facing temporary financial challenges.

One of the primary benefits of small payday loans is their convenience and accessibility. These loans are typically easy to apply for and can be obtained quickly, often within the same day. Many lenders offer online applications, making the process even more convenient for borrowers who may not have the time or ability to visit a physical branch. Additionally, payday loans are available to individuals with various credit scores, making them accessible to a broader range of borrowers.

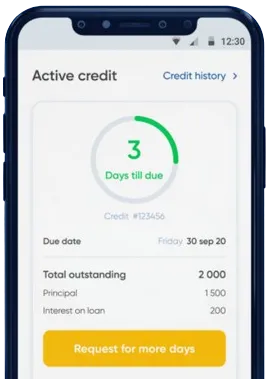

Small payday loans also offer flexible repayment options, allowing borrowers to customize their repayment schedule based on their financial situation. This flexibility can be particularly helpful for individuals who may not be able to make a lump sum payment on their next payday. Lenders often offer extended repayment plans or installment options to accommodate different circumstances, making it easier for borrowers to manage their loan repayments without experiencing financial strain.

In addition to the convenience and flexibility of small payday loans, these loans also feature a fast approval process. Compared to traditional bank loans, which may require extensive documentation and credit checks, payday loans can be approved quickly based on basic eligibility criteria such as income and employment status. This expedited approval process ensures that borrowers can access the funds they need without delay, making payday loans an efficient solution for urgent financial needs.

Small payday loans are subject to regulations and guidelines set by the National Credit Regulator in South Africa, ensuring that borrowers are protected from unfair lending practices. These regulations require lenders to disclose all terms and fees associated with the loan upfront, promoting transparency and accountability in the lending process. Borrowers can review and compare loan offers to make informed decisions, knowing exactly what to expect in terms of interest rates, repayment terms, and any additional charges.

In conclusion, small payday loans in South Africa offer a range of benefits that make them a practical and useful financial solution for individuals in need of quick cash. From their convenience and accessibility to flexible repayment options and fast approval processes, payday loans provide immediate relief to borrowers facing temporary financial challenges. With proper understanding of the terms and regulations governing payday loans, borrowers can confidently utilize this financial tool to address their short-term financial needs.

Small payday loans are short-term loans that are typically taken out to cover unexpected expenses or emergencies. These loans are usually for small amounts and are intended to be repaid on the borrower's next payday.

To qualify for a small payday loan in South Africa, you typically need to have a steady income, a valid South African ID, and a bank account. Some lenders may also require proof of employment or residency.

The amount you can borrow with a small payday loan in South Africa varies depending on the lender and your individual financial situation. Generally, payday loans range from R500 to R4000.

Interest rates on small payday loans in South Africa can be high compared to traditional loans. It is important to carefully read and understand the terms and conditions of the loan before agreeing to it.

Many lenders in South Africa offer quick approval and funding for small payday loans. Some lenders may be able to deposit the funds into your bank account within a few hours or on the same day that you apply.

If you are unable to repay your small payday loan on time, you may incur additional fees and interest. It is important to contact your lender as soon as possible to discuss your options and avoid further financial consequences.